MapleLearn

Transforming Financial Education with Engaging, Interactive Learning and Knowledge-Building Tools

A financial learning app designed to boost new user acquisition

Building on the success of its banking app, MapleBank is expanding its offerings to drive growth and meet evolving customer needs. As part of this vision, we developed MapleLearn, a financial learning app designed to empower users to take charge of their financial future. Through engaging educational content, interactive quizzes, and practical exercises, MapleLearn introduces essential financial concepts, highlights key tools, and equips users with the knowledge to confidently manage their finances.

For this project, we implemented a comprehensive UX process to develop a solution that effectively meets the needs of MapleBank’s clients. We ensured consistent communication throughout, collaborating within the design team, engaging with the client during review meetings, and incorporating user feedback during the design and testing phases. This iterative approach seamlessly integrated the user’s voice with the business perspective.

Research Process

The journey of MapleLearn began with an in-depth research phase to uncover user needs and align with MapleBank’s business goals.

Competitive Analysis

Examined similar financial literacy tools (RBC, Revolut, N26) to identify gaps and opportunities for MapleLearn.

Guerrilla Testing

To supplement the information provided by the client and our previous analyses, we conducted Guerrilla testing directly at a university allowing us to interview 6 students.

Online Surveys

Shared via Reddit and Facebook, yielding insights into user pain points, learning preferences, and expectations.

Key Research Insights

Users struggled with financial terminology and sought simple, visual explanations.

Gamified features like rewards and progress tracking were highly motivating.

Many users appreciated the flexibility to learn at their own pace and revisit content.

Next we developed a persona of Sophia Romano to represent our target users. This was extremely valuable in allowing us to better understand our target audience and make design decisions accordingly.

Design Process

Our design process was iterative and user-focused, ensuring every decision was informed by research and feedback.

Initial Assumptions

Early designs assumed the learning features would integrate into the existing MapleBank app. Prototypes were created with this structure in mind.

Pivot to Standalone App

After discussions with the client, the focus shifted to building a dedicated learning app. This pivot allowed for more flexibility in design and content structure.

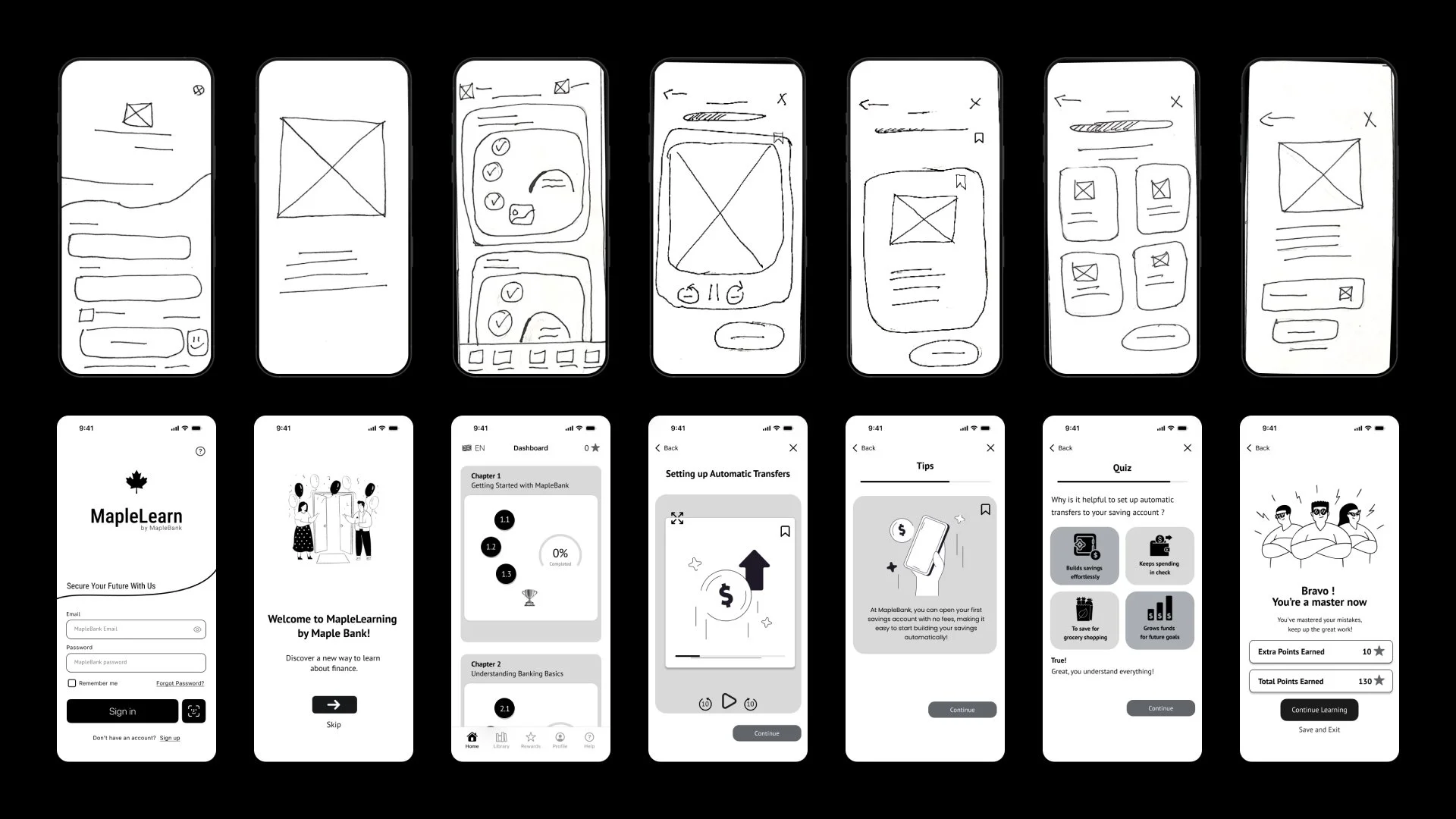

Wireframes and Prototypes

Low-Fidelity Wireframes: Focused on establishing user flows and navigation clarity.

High-Fidelity Wireframes: Incorporated branding, typography, and key visuals to enhance usability.

Interactive Prototypes: Allowed stakeholders and users to test features like the rewards system and lesson modules.

Design Justifications

Our design decisions were based on user research, core design principles, and staying true to MapleBank’s already established brand identity.

Focus on User-Centred Design

Tailored specifically for newcomers to Canada

Simplified navigation for all users

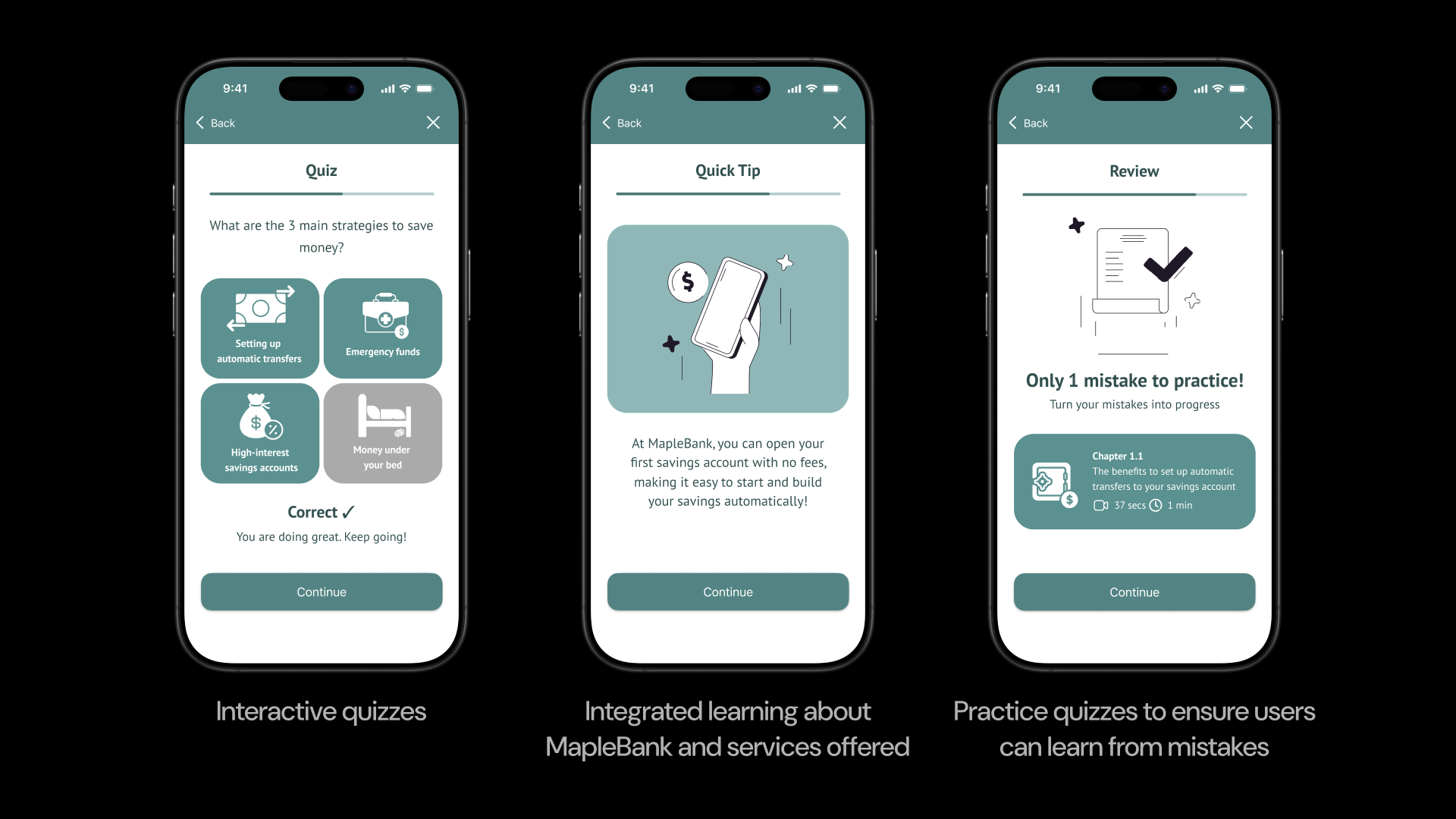

Educational Experience

Video-first approach to simplify complex concepts

Interactive quizzes for immediate feedback

Gamified Rewards Integration

MapleBank reward points, and trophies to drive engagement

Clear progress tracking to encourage continued learning

Modular Content Structure

Library section to review, redo, and explore lessons

Dashboard for tracking progress, rewards, and achievements

Visual and Functional Simplicity

Minimalist layout, clean typography, and intuitive icons for ease of use

Dynamic animations and videos for an interactive experience

Consistent Branding

Use of MapleBank colours and logo throughout reinforces a cohesive and recognizable identity

Goals Achieved

This project successfully resolved key user pain points by designing a tailored, user-centred learning platform:

Simplified Financial Systems

Delivered clear, engaging educational content through videos and quizzes to demystify banking concepts and terminology.

Building Foundational Knowledge

Provided step-by-step lessons that empower users to confidently explore financial products and make informed decisions.

Reducing Complexity

Designed bite-sized modules and interactive quizzes that make learning approachable and maintain user engagement.

Guided Support

Implemented personalized onboarding and clear navigation to guide users through their learning journey effortlessly.

Centralized Access to Resources

Created a user-friendly Library where all lessons and resources are easy to locate, review, and revisit.

Future Recommendations

Strengthen Product Integration

Connect educational content to MapleBank products like savings accounts and credit cards, providing contextual recommendations based on completed lessons.

Increase Accessibility

Expand multi-language support and add features like screen reader compatibility, adjustable text sizes, and high-contrast visuals to ensure inclusivity for all users.

Enhance Interactivity

Introduce engaging elements like interactive scenarios, personalized quizzes, and gamified challenges, along with unlockable content or skill badges to sustain motivation.

Expand Educational Content

Cover advanced topics such as investing and retirement planning, and create tailored lessons for specific user groups while organizing them by skill level (beginner to advanced).

These enhancements will make MapleLearn more inclusive, engaging, and valuable, further solidifying its impact on financial literacy.